Caprolactam spot may exceed 15000 in May

After the May Day holiday (Apr 30-May 4), nylon market has warmed up evidently. The logic in the industry remains similar with the previous insight report “Nylon: key problems faced for May”, that there is no big problem in the supply-demand situation inside this industry, or there may be some pressure but not heavy.

Supply-demand in nylon 6 industrial chain

1. CPL

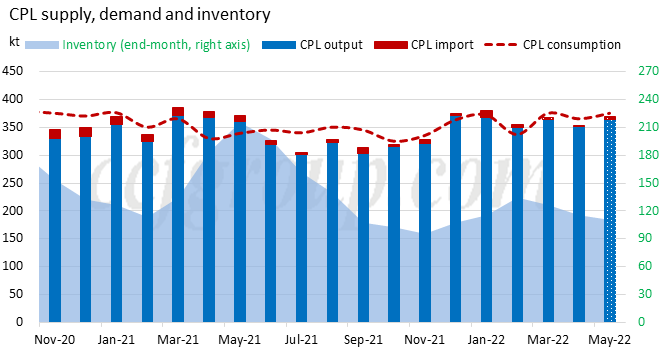

Looking at the inventory status by the end of April, CPL market has no prominent supply-demand problem. But there may be divided situations among different plants. Several CPL plants have had inventory pressure in some period of times, but this pressure could be digested after one or two days of intensive trading, and is not heavy enough to weigh down prices evidently.

The turnaround and restart news in CPL link almost offset each other. So CPL supply side may be relatively steady in the month.

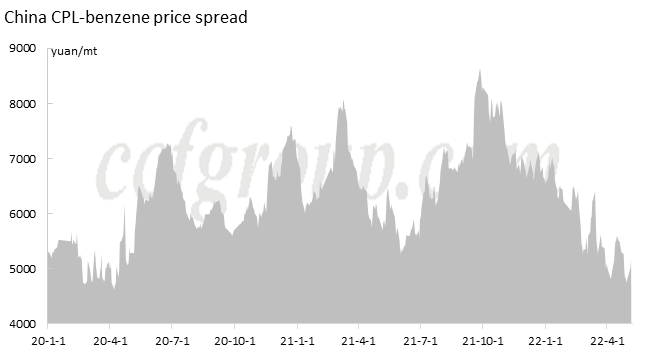

CPL plants have been suffering deficits for relatively long term, and plants have strong willingness to revise up their profit margin. Therefore, CPL sellers are reluctant to sell at previous lows and push up prices actively starting the beginning of May.

2. Nylon 6 chip

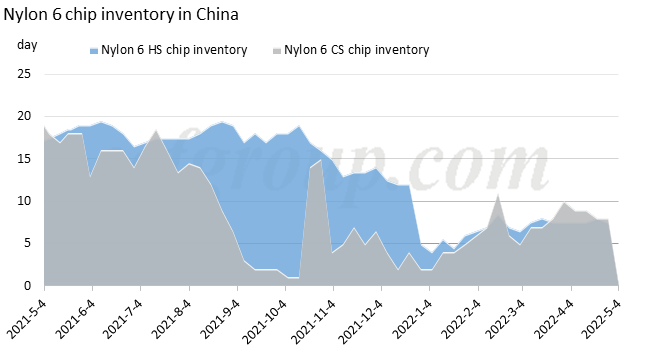

Nylon 6 chip inventory has been steadily reduced since April, and is now in a controllable status. Most polymer plants ran steadily, except for several reduction amid poor logistics and regular maintenance. There has been no chip plants actively cut production for market reason yet.

3. Nylon 6 textile filament (NFY)

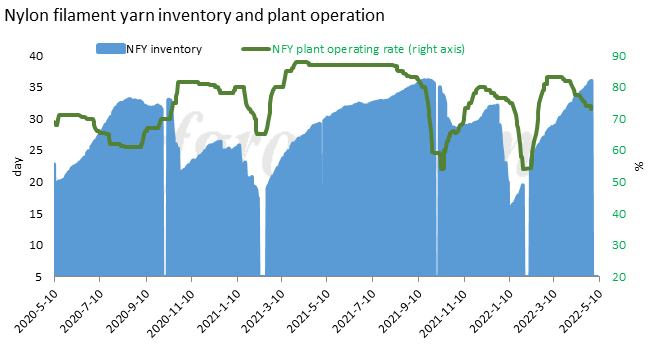

There have been worries about further decline in NFY plants’ operating rate in late April. However, regarding the observation since end-Apr, low-end NFY and nylon 6 DTY plants with heavy inventory pressure have already cut their run rate to enough low rate. It means the risk of further reduction in NFY production has been released out almost.

It is difficult for NFY plant operating rate to drop further in May. At the same time, NFY inventory may still accumulate. But when upstream CPL and nylon 6 chip prices increase, it will also help liquidate NFY inventory to some extent. By early May, raw material inventory in downstream sectors is still heard at low rate, and this situation needs to be further observed and verified.

To sum up, as there is no evident problem in supply-demand structure, caprolactam market is like a boat drifting in the ocean, how far and which direction will it sail depends on the tide. CPL market development is under the guidance of crude oil, benzene and the major macro events including the pandemic situation.

External influences

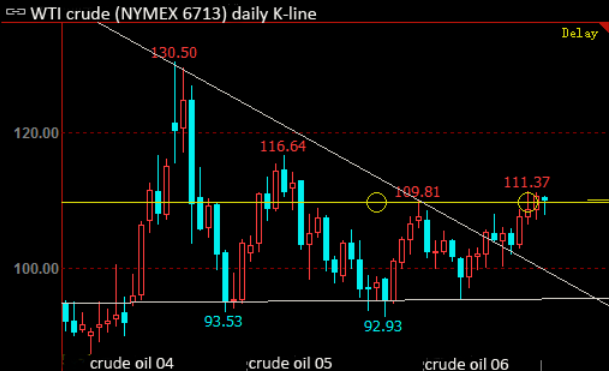

Entering May, crude oil moved upward, as the Federal Reserve raised interest rates, which was in line with market expectations, EU planned to impose sanctions on Russia in crude oil, and demand for refined oil products was good. In addition, OPEC+ kept gradual production increase in Jun, also supportive to oil price.

Regarding the pandemic control in China, except for several regions with large number of infections, the logistics problem is basically resolved and the daily increase of the number of COVID cases is falling. The situation is getting better step by step.

Based on these two most important external influences, CPL suppliers have strong appeal to revise up previous negative profit margin when the cost is still rising up. The bearish influences seem have been all fulfilled in April already, and the environment in May is positive on the whole. In conclusion, CPL market may keep a general uptrend in May, and the RMB spot price may surge to exceed 15,000yuan/mt if crude oil futures further strengthens as expected.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price