CPL and nylon 6 price almost same high, how do polymer makers survive?

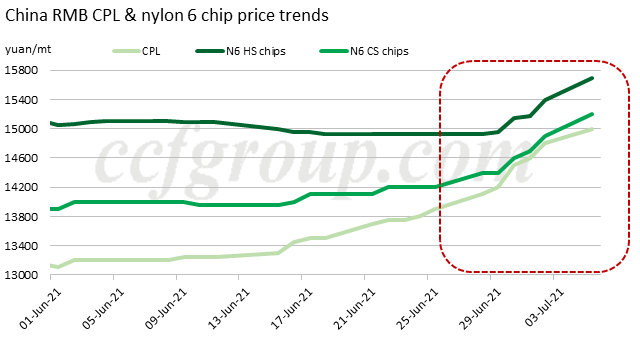

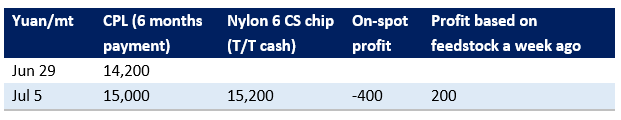

In the past three week, caprolactam and nylon 6 chip market have been rising continuously, but CPL price increase was apparently faster than its downstream polymer. By July 5, CPL RMB spot stood up to the platform 15,000yuan/mt (6 months payment), a highest rate in the past 32 months (the last highest price in CPL RMB spot was seen on November 16, 2018, at 15,000yuan/mt). This rate was almost same high with nylon 6 conventional spinning (CS) chip spot (15,200yuan/mt, T/T cash). To consider the price spread between the different payment (around 250yuan/mt), CPL RMB spot and nylon 6 CS chip spot price spread was around 450yuan/mt, which was apparently lower than the mainstream break-even line from CPL to PA6 CS chip, 850yuan/mt.

Why are CPL and nylon 6 price almost same high?

The reasons are summarized from both sides.

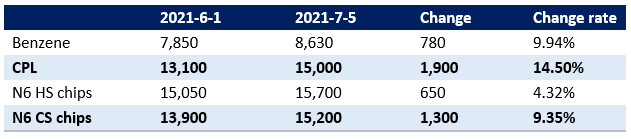

1. As benzene price hiked, CPL spot quickly caught up in turnaround season.

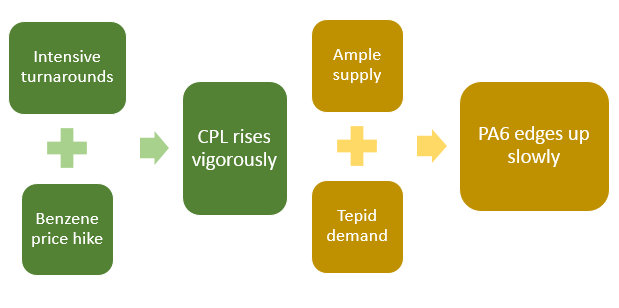

The firmness in CPL market came mainly from the strong performance of benzene and tightening CPL supply.

First, despite the seemingly high price, CPL makers were not in lucrative profit, as it was just chasing up benzene. CPL-benzene price spread had dropped to a lowest point in early June, when CPL plants were under deficits already, and the profit was only recovered by the end of June when the price hike in CPL surpassed its feedstock.

Second, intensive turnarounds had injected much force to CPL plants. Since mid-June, 2021, increasing number of CPL plants had cut or shut production for turnarounds, as CPL plants operating rate was falling from 92% on June 11 to 59% by July 5, down 33 percentage points in just 24 days. The supply was already tight since end-June, and situation became more extreme in July. It provided a solid base for CPL suppliers to raise offers.

2. Nylon 6 chip was still burdened by high stock and tepid demand.

Compare with CPL market, nylon 6 chip plants had been struggling with high inventory over the past months and gradually weakening demand in summer. Though CS chip plants had cut operating rate to as low as 62%, their average inventory stayed above half a month, which was difficult to handle for the spot-trading oriented CS chip sellers. In addition, consumption was gradually weakening with the temperature going up toward summer. Most downstream sectors including modified plastics, fish net, etc. were in their traditional off-season. To face the reality, CS chip plants were more cautious in raising their prices, as it was opposed to the already weak demand.

The real cost of nylon 6 CS chip plants

Based on the hand-to-mouth mode of purchasing, nylon 6 CS chip was under deep deficits. But the actual situation was not that bad. Based on CPL spot on July 5 (15,000yuan/mt, 6 months payment), the spot profit of CS chip plants was -400yuan/mt (considering the price spread between the 250yuan/mt spread of different payments). But actually with CPL prices rising up too fast, trades were very thin. If taking CPL spot price a week ago (Jun 29, 14,200yuan/mt, 6 months payment) as the cost, CS chip plants had around 200yuan/mt profit.

In the more ideal scenario, when nylon 6 CS chip plants replenished feedstock intensively when the prices were relatively low, the real cost of CS chip plants was much lower than current CPL spot, and CS chip plants still had chance to make thin profit. And the real case is that many CS chip plants are trying to lock down feedstock cost before market truly goes up, and only restock to cover urgent demand after feedstock price surge.

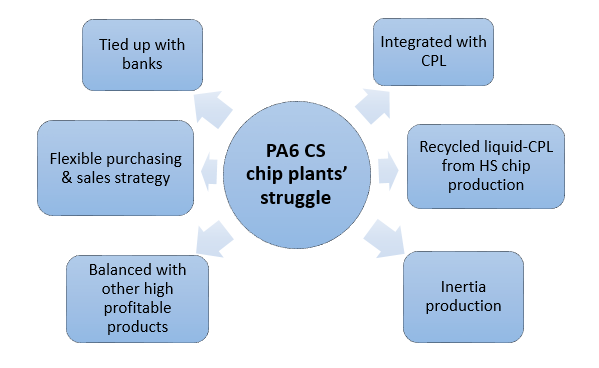

How did CS chip plants survive?

Nylon 6 CS chip market has indeed been in a hard mode for a long term. From the macro point of view, supply and demand pattern was key to the difficulties in CS chip market. The expanded capacity over the past few years and weaker demand in 2021 have caused the continuing weak performance of CS chip market.

And from the micro side, disorderly competition among large number of medium-small-sized CS chip was another important reason. And different plants had actively or passively taken different methods to cope with the hard mode. They are mainly concluded as below 6 types.

1. Integrated with CPL

Part of nylon 6 CS chip plants are integrated with CPL production, especially in North China. These integrated plants could make profit from CPL sales and thus balance the deficits in CS chip sector. This is acceptable for them in the view of a long-term strategy.

2. CS chip made from recycled liquid-CPL from HS chip production

Some CS chip plants are producing both HS chip and CS chip, and normally they would use the recycled liquid-CPL from HS chip production to make CS chip, which normally requires lower CPL qualities. So here, CS chip lines are positioned as the “liquid-CPL recycling unit” of HS chip lines, and as long as the HS chip lines keep operating, the related CS chip lines will not stop.

3. Inertia production of new capacities

Since the last quarter of 2020, there have been new CS chip capacities released gradually. It is unacceptable for the enterprises to stop a new line after just half a year of operation, and they would rather bear the deficits for a period of time before they fully merge into the market.

4. Balanced with other high-profitable products

Part of nylon 6 chip plants have a grand varieties of products, from dull, high-viscosity industrial-grade chip, to contracted semi-dull HS chip (which is able to profit stably). Their downstream sectors are widely spread. The large profit portfolio could support CS chip production when the company still include this product in their long-term market strategy.

5. Flexible purchasing & sales strategy

As mentioned above, in an ideal scenario, CS chip plants could secure large volume of CPL at a reasonable low rates and sell chip normally, they are still making narrow profits or control the deficits at low.

6. Tied up with banks

A small number of enterprises are operating to keep the turnover in their bank account.

These points are all explaining why nylon 6 CS chip plants are still struggling with the deficits, and they have almost included all types of CS chip enterprises in China.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price